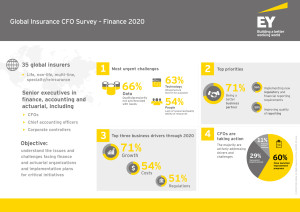

Global professional services organization Ernst & Young Global Limited has announced the results of its latest Global Insurance Survey. This chief financial officer (CFO) survey shows that achieving growth, expanding into new markets, and growing through mergers and acquisitions are seen as the top drivers for global insurers in the next five years.

Some key findings from the global insurance survey include:

- Top three business drivers: #1 Growth, #2 Managing Costs and #3 Regulatory Changes

- Two-thirds of respondents rank data and technology issues among the top three challenges facing finance and actuarial functions; participants on average score data as their least developed capability

- By 2020, the most significant shifts in maturity levels by operating model will be in data management and technology capabilities

- Respondents expect onshore shared services to support transaction processing functions, with outsourcing selectively used for payroll and internal audits

- Decision support and controls are expected to account for a larger share of finance and actuarial headcount by 2020

Three key areas where insurers can take action:

- Modify current reporting processes by developing an efficient reporting solution architecture

- Deliver timely and relevant management information and link strategic objectives to performance indicators

- Improve finance and actuarial operational performance by using the right skills and processes to strike a balance between effectiveness and efficiency

View the infographic: